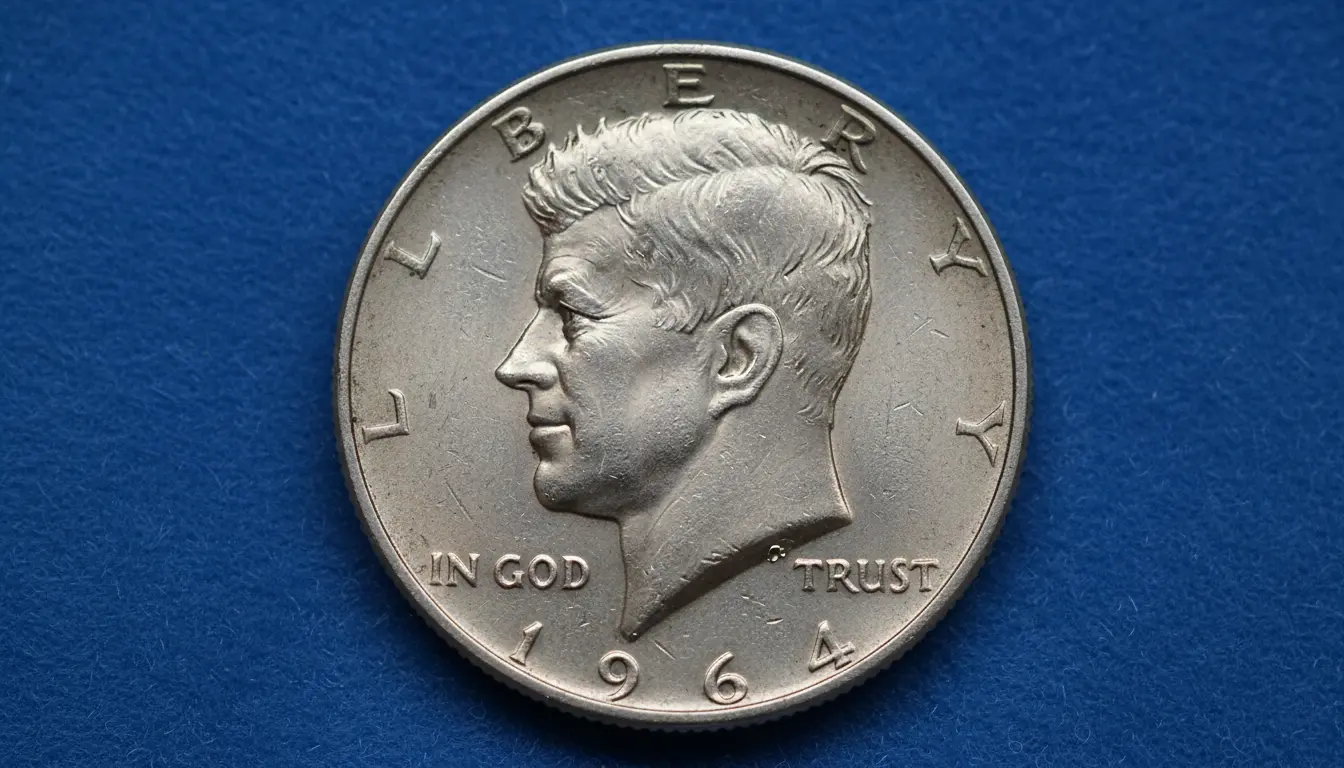

How a 1964 Kennedy Half Dollar can be worth more than gold

The 1964 Kennedy half dollar is a common topic for collectors and investors because its market value often goes beyond the metal it contains. That can make it worth more than the equivalent small amount of gold in certain comparisons.

This article explains the reasons, how to evaluate a coin, and a short case study to show how the math and market work together.

Key facts about the 1964 Kennedy Half Dollar

The 1964 Kennedy half dollar is the only year the new design was struck in 90% silver for general circulation. The coin contains 0.36169 troy ounces of pure silver and was minted in Philadelphia (no mint mark), Denver (D), and San Francisco (S proofs).

Collectors prize higher grades, proof strikes, and mint-state survivors. These numismatic factors create value well beyond the coin’s metal content.

Important properties

- Composition: 90% silver, 10% copper.

- Silver content: 0.36169 troy oz of pure silver.

- Mint marks: Philadelphia (no mark), Denver (D), San Francisco proofs (S).

- Only 1964 Kennedy halves were 90% silver for general circulation.

Why a coin can be worth more than gold

When people say a 1964 Kennedy half dollar is “worth more than gold,” they usually mean one of two things. First, its collectible market price can exceed its silver melt value. Second, in a direct comparison of value-per-piece to a small amount of gold, a high-grade coin can sell for more than a similarly sized piece of gold would cost.

These outcomes come from rarity, condition, eye appeal, provenance, and demand — all drivers of numismatic premiums.

Numismatic premiums vs. metal value

- Base metal value: determined by the coin’s silver content and the spot price for silver.

- Numismatic premium: additional price collectors pay for grade, rarity, or historical interest.

- Supply and demand: fewer high-grade examples means higher prices for collectors and dealers.

How to compare a half dollar to gold

Use straightforward math to compare values. Multiply the coin’s pure silver content by the current silver price to get melt value. Compare that to the coin’s market price listed by dealers, auction results, or price guides.

To compare to gold, find the value of a small gold unit (for example, 0.1 troy oz) and compare the two market prices. Because gold trades at a much higher rate per ounce, a coin will rarely match equal weight for weight, but it can exceed the market price of a small gold fraction when assigned a high numismatic premium.

Quick example calculation

- Silver spot: $25 per troy ounce (example).

- 1964 half silver content: 0.36169 oz × $25 = $9.04 melt value.

- If a certified MS66 sells for $600, the numismatic premium is $590.96.

- Compare to gold: if a 0.25 oz gold round costs $500, that particular half dollar can be worth more than that gold piece in collector value.

Which variants drive higher value for the 1964 Kennedy Half Dollar

Not all 1964 halves are equal. Factors that raise value include high grades (MS65 and above), proof coins (S designation), special mint sets, and notable errors or varieties.

Collectors also pay more for coins that are certified by respected services (PCGS, NGC) at top grades, since certified coins are easier to buy and sell with confidence.

Common value drivers

- Mint-state grade (MS65, MS66, MS67+).

- Proof strikes from San Francisco (PR/SF designations).

- Low-population grades where few coins exist certified at that level.

- Attractive toning or original surfaces that appeal to collectors.

Practical steps to evaluate a 1964 Kennedy Half Dollar

If you own or are considering buying a 1964 Kennedy half dollar, use these steps to assess whether it could be worth more than a comparable gold amount.

- Check the coin’s grade — amateur grades give only a rough idea; consider professional certification.

- Identify the mint mark and whether the coin is a proof (S) or business strike.

- Compare current spot prices for silver and gold to compute melt values.

- Consult price guides, auction records, and dealer listings for market prices by grade.

- Factor in certification and desirability when estimating premium.

Real-world example — assessing value in practice

Case study: a collector evaluates a certified 1964 Kennedy half graded MS66 by a major service. The current silver spot price values the coin’s melt at around $10, but the certified coin is listed by a dealer at $650 due to rarity in that grade.

The collector compares that $650 to small gold fractions available in the market. A 0.1 oz gold piece might cost $190 at current gold prices, so the certified half’s market price exceeds the gold fraction in terms of what a buyer would pay.

This shows how collector demand and certification can push a coin’s price above the simple metal comparisons.

Takeaway for collectors and investors

The 1964 Kennedy half dollar is worth more than gold in specific, practical comparisons when numismatic premiums are strong. The coin’s silver content establishes a floor value, but grade, rarity, and certification determine its true market price.

Always verify grade and market data before buying. For most owners, rare high-grade or proof 1964 halves represent numismatic value that eclipses their metal content — and sometimes the cost of small gold fractions — because collectors pay for scarcity and condition.

If you want a quick evaluation of a specific coin, provide high-resolution photos, the grade (if certified), and the mint mark, and you can get a clearer estimate from dealers or auction records.